Understanding the historical stock price of Caterpillar is crucial for investors and analysts alike. Caterpillar Inc. is a leading manufacturer of construction and mining equipment, diesel and natural gas engines, and industrial gas turbines. The company's stock performance reflects its operational efficiency, market trends, and overall economic conditions. In this article, we will explore the historical stock price of Caterpillar, analyze key factors influencing its performance, and provide insights for future investments.

The stock market can be unpredictable, and historical data plays a vital role in making informed investment decisions. By analyzing Caterpillar's historical stock price, investors can identify patterns and trends that may indicate future performance. This article will delve into the various aspects of Caterpillar's stock price history, including significant events that impacted its valuation, financial performance, and market sentiment.

In addition to historical price analysis, we will also discuss Caterpillar's current market position and forecast potential future trends. This comprehensive guide aims to equip you with valuable information and insights necessary for navigating investments in Caterpillar Inc. and understanding its historical stock price dynamics.

Table of Contents

1. Caterpillar Overview

Caterpillar Inc., founded in 1925, is one of the world's largest manufacturers of heavy machinery and equipment. The company is headquartered in Deerfield, Illinois, and serves customers in construction, mining, and agriculture sectors. With a rich history of innovation and expansion, Caterpillar has established itself as a leader in the industry.

| Data | Details |

|---|---|

| Founded | 1925 |

| Headquarters | Deerfield, Illinois, USA |

| CEO | Jim Umpleby |

| Industry | Construction and Mining Equipment |

| Stock Symbol | CAT |

2. Historical Stock Price Analysis

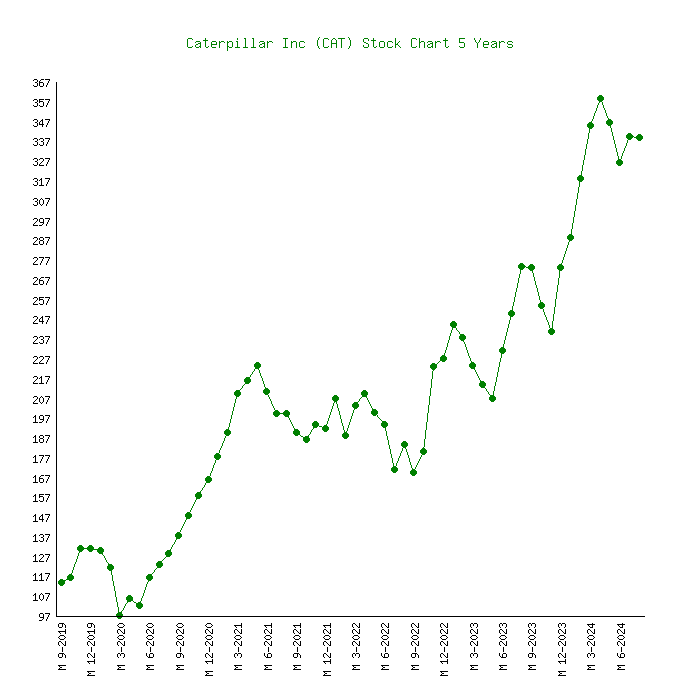

The historical stock price of Caterpillar provides valuable insights into the company's performance over the years. By examining the company's stock price trends, investors can gain a better understanding of how external factors have influenced its valuation. Below is a brief overview of Caterpillar's stock price performance over the last decade:

- 2010-2015: Caterpillar's stock price experienced significant growth, driven by a recovery in the global economy and increased demand for construction and mining equipment.

- 2016: The stock faced challenges due to a downturn in the mining sector, which negatively impacted sales and profitability.

- 2017-2019: A rebound in the global economy and infrastructure spending led to a resurgence in Caterpillar's stock price.

- 2020: The COVID-19 pandemic caused market volatility, resulting in a decline in Caterpillar's stock price.

- 2021-Present: The stock has shown recovery as demand for construction equipment increases and supply chain issues begin to resolve.

3. Key Factors Influencing Stock Price

Several key factors influence the historical stock price of Caterpillar, including:

3.1 Economic Conditions

The overall economic environment significantly impacts Caterpillar's stock price. Factors such as GDP growth, unemployment rates, and consumer spending can influence demand for construction and mining equipment.

3.2 Commodity Prices

As Caterpillar operates in the mining sector, fluctuations in commodity prices can directly affect its sales and profitability. When commodity prices rise, demand for mining equipment typically increases, leading to higher stock prices.

3.3 Infrastructure Spending

Government spending on infrastructure projects can boost demand for Caterpillar's products. Increases in infrastructure investment often correlate with rising stock prices for construction equipment manufacturers.

4. Financial Performance Indicators

To assess Caterpillar's historical stock price, it is essential to analyze key financial performance indicators. These indicators include:

- Revenue Growth: Consistent revenue growth indicates strong demand for Caterpillar's products and services.

- Profit Margins: Higher profit margins suggest efficient operations and effective cost management.

- Return on Equity (ROE): A high ROE indicates that Caterpillar is effectively utilizing shareholder equity to generate profits.

- Debt-to-Equity Ratio: A manageable debt-to-equity ratio indicates financial stability and lower risk for investors.

5. Market Trends and Competitors

Understanding market trends and competitors is vital when analyzing Caterpillar's historical stock price. Key trends include:

5.1 Technological Advancements

The construction equipment industry is witnessing rapid technological advancements, including automation and artificial intelligence, which can impact Caterpillar's market position.

5.2 Global Competition

Caterpillar faces competition from other major players in the industry, including Komatsu, Volvo, and Hitachi. Analyzing competitor performance can provide insights into Caterpillar's relative market strength.

6. Investor Sentiment and Analyst Outlook

Investor sentiment plays a crucial role in shaping stock prices. Positive analyst ratings and forecasts can lead to increased investor confidence and higher stock prices. Key factors influencing investor sentiment include:

6.1 Earnings Reports

Quarterly earnings reports provide insights into Caterpillar's financial health. Strong earnings can boost investor confidence and drive stock prices higher.

6.2 Analyst Ratings

Analysts' ratings and price targets can influence investor decisions. Positive recommendations can lead to increased buying activity, positively impacting stock prices.

7. Future Stock Price Predictions

While predicting future stock prices is inherently uncertain, analysts use various methods to provide forecasts. Factors that could influence Caterpillar's future stock price include:

- Infrastructure Investment: Continued government spending on infrastructure can support demand for Caterpillar's products.

- Global Economic Recovery: A robust recovery from economic downturns can lead to increased demand for construction and mining equipment.

- Technological Advancements: Innovations in equipment and services can enhance Caterpillar's competitive edge and attract more customers.

8. Conclusion

In summary, understanding the historical stock price of Caterpillar is crucial for investors seeking to make informed decisions. By analyzing key factors influencing stock price, financial performance indicators, market trends, and investor sentiment, investors can develop a comprehensive view of Caterpillar's market position and potential future performance. We encourage readers to stay updated on Caterpillar's performance and consider the insights shared in this article when making investment decisions.

We invite you to leave a comment below, share this article with others, or explore additional articles on our site for more insights into investment strategies and market analysis.

Thank you for reading! We look forward to providing you with more valuable content in the future.

ncG1vNJzZmidkajBpr7IrKOappSpvLa%2ByKykZ5ufonyktMCsoKefo6mus7DOpmlpZ5OWwaa%2Bz6KjpZmiYrWqv9OoqaKbkaF6tMDOnKJmqKKesKZ6x62kpQ%3D%3D